Why Tax Accountants Need Digital Document Management

Tax professionals can reduce clutter and speed up document retrieval digitally.

Embracing digital solutions for efficient document management in the accounting profession.

Tax accountants deal with complex tasks during tax season. They process client returns and stay on top of deadlines. They also handle sensitive financial information. Managing large volumes of paper documents adds unnecessary complexity to their daily operations. Digital document management simplifies these processes. It improves workflow efficiency and reduces human error. Additionally, it enhances security, making it an essential tool for modern tax professionals.

Streamlined Document Storage and Retrieval

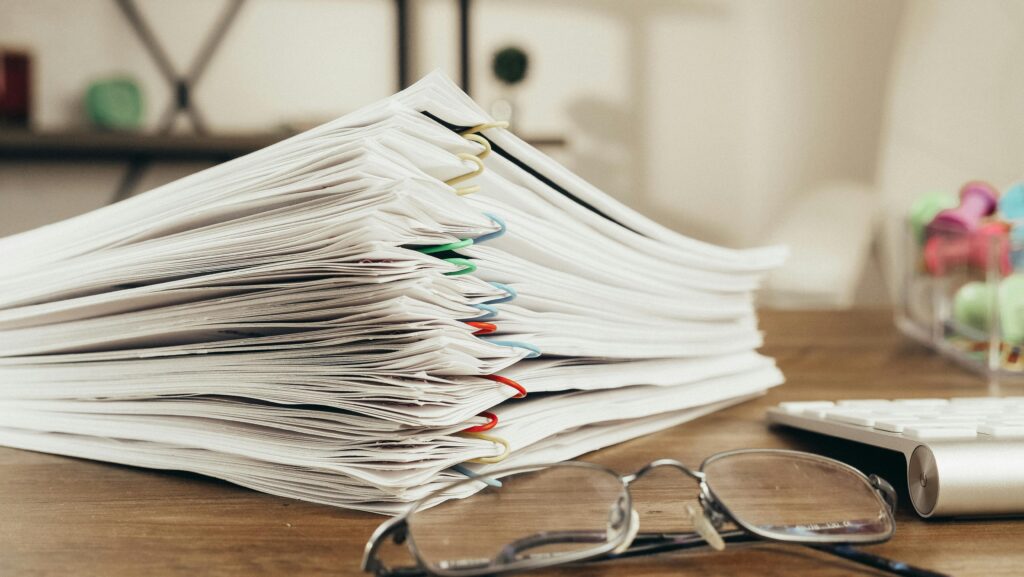

One of the biggest headaches for tax accountants is managing mountains of paper—tax forms, client records, receipts, and returns. Storing these physical documents requires time and space, and searching through piles of paper is both inefficient and error-prone.

By switching to a digital document management system, accountants can organize and store all their documents securely in a cloud-based platform. This system allows easy categorization by client, tax year, and document type. With everything stored electronically, accountants can instantly retrieve any file with a simple search, eliminating the need to dig through cabinets and file folders. This saves time and reduces the risk of lost or misplaced documents.

Improved Client Communication

Collecting documents from clients is often one of the most time-consuming parts of the tax preparation process. Clients may forget to send certain forms, or they might have difficulty keeping track of everything they need to provide. Digital document management systems can help streamline this process.

With secure client portals, clients can upload their tax documents directly into the system, eliminating the need for emails, phone calls, and physical document exchanges. Accountants can easily track which documents are still pending and remind clients in real time if anything is missing. This leads to smoother, faster communication and a better overall client experience.

Enhanced Security for Sensitive Information

Tax accountants handle sensitive data, including Social Security numbers, financial statements, and other confidential documents. Paper records are vulnerable to loss, theft, and damage, especially if the documents are mishandled or stored improperly.

Digital document management provides a secure and encrypted environment for storing sensitive client data. With role-based access controls, accountants can restrict document access to only authorized individuals. This ensures that sensitive information stays secure and compliant with privacy regulations. Additionally, automatic backups and audit trails provide an extra layer of protection, making sure documents are recoverable and traceable in case of any issues.

Faster Document Access

For tax accountants, speed is everything. When working with multiple clients, having to wait for or manually search for documents can eat up valuable time. Digital document management allows accountants to access any document instantly, without the need to sift through stacks of paper.

Whether it’s reviewing a client’s previous tax return, pulling up supporting documents, or checking for missing forms, a cloud-based system provides instant access. With everything organized and easily searchable, accountants can quickly retrieve the documents they need, allowing them to focus on the actual work rather than wasting time on document retrieval.

Simplified Workflow and Task Management

Tax season is often a race against the clock, with multiple deadlines and high client expectations. Missing a deadline can lead to penalties or unhappy clients, so staying organized is critical.

Digital document management systems often come with workflow and task management tools, helping accountants keep track of pending tasks and important deadlines. These tools enable accountants to set reminders. They can assign tasks to team members. Accountants can also track the progress of each client’s tax return. By integrating task management into the document storage system, accountants can ensure that nothing falls through the cracks and that every deadline is met on time.

Audit Preparation Made Easy

When tax audits arise, accountants must respond quickly by providing documentation to the authorities. The challenge with paper records is that finding the right documents under time pressure can be a stressful and inefficient process.

With a digital document management system, accountants can easily retrieve the necessary documents for audits, minimizing the time spent gathering materials. The system’s search functionality allows accountants to quickly find specific documents by client, date, or document type. Audit trails keep track of who accessed the documents and when. This organization reduces stress during audits and makes the entire process more manageable.

Increased Team Collaboration

Tax firms often have multiple accountants working on different aspects of the same client’s tax filing. With paper documents, sharing files or collaborating on specific returns can slow down the process.

A cloud-based digital document management system facilitates real-time collaboration. Multiple team members can access and edit documents simultaneously, regardless of location. This reduces bottlenecks, increases productivity, and ensures a smoother workflow. For firms with remote teams or employees working from different offices, this is a major advantage in maintaining seamless operations.

Build Long-Term Client Relationships

A key element of a successful tax practice is building lasting client relationships. Efficient document management improves the overall client experience by making interactions faster and more professional.

By using digital tools, tax accountants can keep accurate and up-to-date records for every client. When clients return year after year, having their previous records organized and easily accessible allows accountants to provide more personalized service. Clients appreciate the smooth, paperless experience and feel confident knowing their data is secure and easily retrievable.

Cost Savings and Environmental Benefits

The costs associated with managing paper documents—printing, filing, storing, and archiving—add up quickly. Digital document management eliminates the need for paper, ink, physical storage space, and printing costs. The transition to digital is not only environmentally friendly, but it also reduces operational expenses for tax firms.

Moreover, the time saved on organizing, retrieving, and managing documents digitally means accountants can focus on providing higher-value services to clients, ultimately improving their bottom line. By going paperless, firms can achieve long-term cost savings and become more efficient in their day-to-day operations.

Conclusion

The move to digital document management offers clear benefits for tax accountants. By organizing and storing documents electronically, accountants can save time, reduce human error, improve client communication, and ensure the security of sensitive information. The right digital tools help streamline workflows, make audits easier, and increase collaboration among team members.

Tax accountants who embrace digital document management can offer better service to clients, reduce costs, and operate more efficiently. In a world where time is money and client expectations are higher than ever, going digital is no longer optional—it’s a game-changer. Your firm should adopt digital document management now. It’s time to take the next step toward improving your practice.