Cloud vs On-Premises: Strategic Choices for Modern Accounting Firms in 2025

On a rainy Thursday morning in London, the partners at a mid-sized accounting firm gathered around a screen as their IT director walked them through the first live reports from their new cloud-based accounting system. For decades, the firm had relied on servers stored in an office basement, racks of hardware tended by an in-house IT team. As client demand for real-time reporting and remote collaboration grew, those servers became a constraint. Within hours of going live, staff could access client accounts from home, review audit files on tablets, and collaborate across departments. Partners described the change as immediate and material, a glimpse of how modern accounting firms are redefining workflow, client service, and efficiency in 2025.

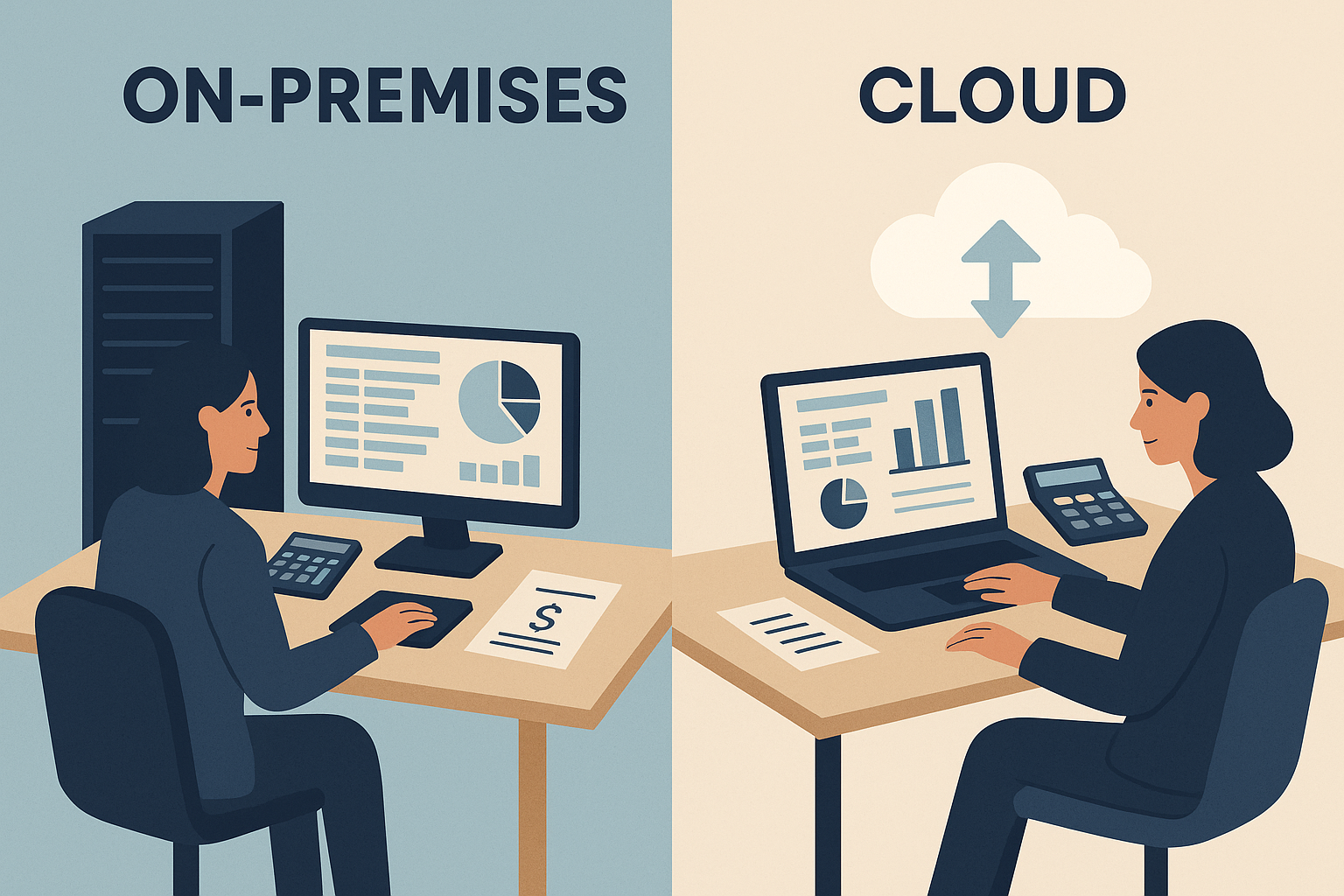

That weekend migration was more than a technical upgrade; it illustrated a broader challenge facing modern accounting firms today: balancing the familiarity and control of on-premises systems with the speed, collaboration, and real-time insights offered by cloud platforms.

Why the Choice Matters

The accounting profession is in transition, but adoption is uneven. A survey of nearly 500 firms found that 43% had migrated less than 75% of their operations to the cloud, highlighting a cautious approach among many mid-sized practices. Firms that embrace cloud solutions at scale, however, report measurable benefits. According to Wolters Kluwer, cloud-enabled firms were around 15% more likely to see revenue growth and 16% more likely to improve profitability compared with firms relying primarily on on-premises systems.

Cathy Rowe, Senior Vice President and Segment Leader at Wolters Kluwer Tax & Accounting North America, commented on the firm’s global study, noting, “The accounting industry is undergoing significant changes driven by advancing technologies such as generative AI, automation, and machine learning. The future belongs to those who embrace technology and innovation as essential parts of their firm’s strategic plans for success.”

Beyond revenue, firms report higher productivity per employee. A recent industry analysis found that practices with mature technology stacks can earn roughly 39% more per employee than less digitally advanced competitors, giving them a tangible advantage in recruiting and retention.

Why Many Firms Still Hesitate

Despite clear advantages, many practices remain cautious. Migration requires careful project management, data cleansing, and integration with legacy systems, which can strain internal IT teams. Security and compliance concerns are also paramount. Surveys of professional accountants show that a majority cite data governance as a significant barrier. Cyber risk is also cited as a significant barrier to cloud adoption.

Some partners worry that moving sensitive client data off-premises exposes them to risks they cannot fully control. These concerns are especially pronounced in sectors with stringent regulatory or residency requirements.

The Practical Case for Cloud

When executed carefully, cloud platforms streamline operations for modern accounting firms, reducing manual reconciliations, enabling real-time collaboration, and automating routine processes. Firms report faster reporting cycles, improved client responsiveness, and a greater ability to redeploy staff toward advisory services.

“Cloud has allowed us to redeploy 20% of our audit staff into advisory services,” said David Chen, CIO of a mid-sized US firm. “The technology translates directly into client value and revenue.”

AI adoption is further accelerating demand for cloud systems. Leading mid-market networks are investing heavily in machine learning to automate tax, audit, and advisory workflows. RSM US, for example, announced a $1 billion technology investment with a strong AI focus, signaling that firms preparing to deploy AI at scale favor cloud-native architectures for faster rollout and integration.

The Case for On-Premises and Hybrid Models

For some modern accounting firms, on-premises infrastructure remains essential for bespoke workflows, sensitive client data, or regulatory compliance. Hybrid models are increasingly common, allowing firms to keep critical workloads in-house while leveraging cloud platforms for collaboration, client portals, and analytics.

“Hybrid solutions let us protect critical data while still accessing cloud efficiencies,” said James Thornton, partner at the London firm. “It’s about picking the right tool for each job, not choosing one over the other.”

Before and After, in Practice

Before migration, many firms relied on a patchwork of desktop applications, VPN-dependent remote access, and slow, manual reporting. After moving to cloud systems, firms report automated workflows, live client dashboards, and auditors working seamlessly from multiple locations. The London firm’s weekend migration cut error rates, shortened audit cycles, and allowed staff to focus on higher-value advisory work.

Making a Strategic Choice

Partners evaluating cloud versus on-premises should weigh five key factors: growth plans, CapEx versus OpEx preferences, regulatory requirements, IT capabilities, and AI adoption. For most mid-sized firms, these considerations point to a hybrid architecture: a tailored combination of cloud agility and on-premises control. By weighing options thoughtfully, modern accounting firms can design a technology strategy that balances efficiency, security, and scalability, ensuring long-term competitiveness.

Final Thoughts

Cloud and on-premises systems each offer distinct advantages for accounting firms. Cloud platforms provide scalability, remote access, and support for AI-driven workflows, while on-premises systems maintain control, customization, and data residency. Many firms adopt a hybrid approach to balance efficiency with security. The choice depends on a firm’s growth plans, regulatory requirements, internal IT capabilities, and strategic priorities. Evaluating these factors allows modern accounting firms to make an informed decision about the technology architecture that best supports their operations and client service in 2025.